Discover how the smava Kreditpartnerprogramm DE works and what makes it a profitable affiliate opportunity in the German finance market. This blog post reviews commission structures, key benefits, and promotion strategies, helping affiliates understand how to earn by promoting smava’s trusted loan comparison platform.

Table of Contents

Introduction to Affiliate Marketing in the Finance Sector

Affiliate marketing in the finance niche is not for the faint-hearted—but if done right, it can be extremely rewarding. Unlike low-ticket products, financial services like loans bring high user intent and strong conversion value.

Why Finance Affiliate Programs Are Highly Profitable

People searching for loans are ready to act. They compare, calculate, and apply quickly. That makes finance affiliate traffic some of the most valuable online.

Growing Demand for Loan Comparison Platforms

With rising living costs and changing financial needs, borrowers increasingly rely on comparison platforms to find fair and transparent loan offers.

What Is smava Kreditpartnerprogramm DE?

smava runs one of Germany’s most popular online loan marketplaces, connecting borrowers with banks and financial institutions.

Overview of smava as a Financial Marketplace

smava allows users to compare personal loans from multiple lenders in one place, helping them find competitive interest rates without visiting multiple banks.

Purpose of the smava Kreditpartnerprogramm

The affiliate program rewards partners for referring users who apply for loans through smava’s platform.

Who Can Join the Program

Finance bloggers, comparison websites, SEO publishers, and performance marketers can all apply.

Understanding the smava Brand in Germany

smava’s Position in the German Loan Market

smava is a well-established name in Germany’s digital finance ecosystem, known for transparency and reliability.

Trust, Transparency, and Consumer Confidence

Trust is everything in finance. smava’s reputation significantly improves conversion rates for affiliates.

Why Borrowers Choose smava

Clear comparisons, strong lender partnerships, and user-friendly tools make smava a preferred choice.

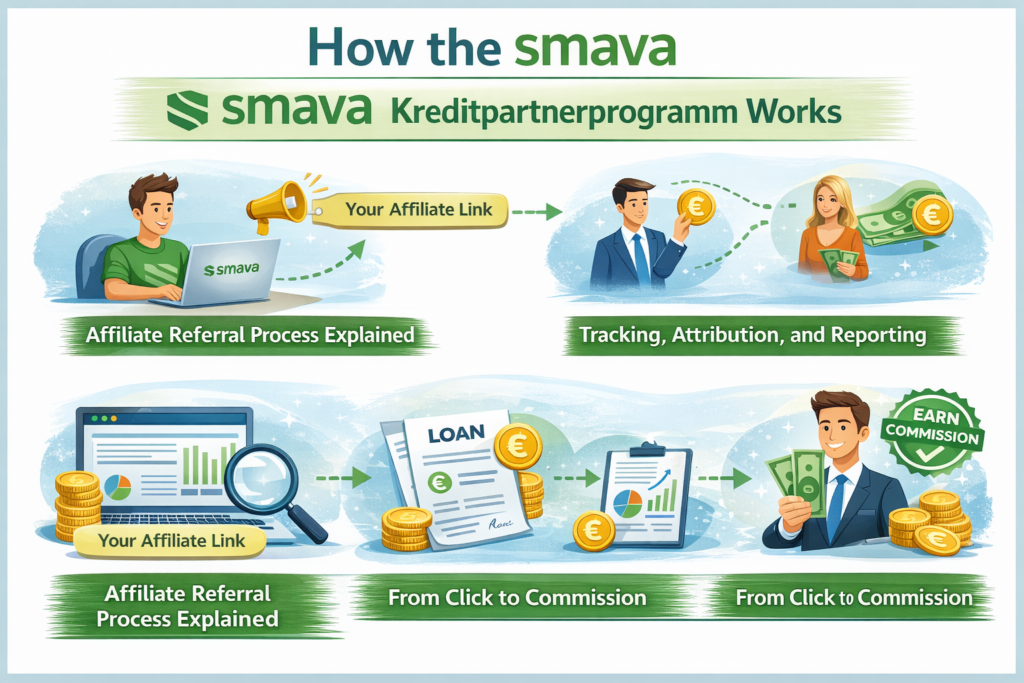

How the smava Kreditpartnerprogramm Works

Affiliate Referral Process Explained

Affiliates promote smava using tracked links. When users click and submit loan applications, those actions are recorded.

Tracking, Attribution, and Reporting

Advanced tracking ensures affiliates receive credit for valid leads and applications.

From Click to Commission

Commissions are typically earned once a qualified action (such as a completed application) is confirmed.

Commission Structure Explained

How Affiliates Earn Money

Affiliates earn a fixed or variable payout per qualified lead or approved loan application.

Typical Payout Models

Most partners work with CPA (Cost Per Action) models, common in finance affiliate marketing

Factors That Influence Commission Amounts

Lead quality, user location, and loan completion rates all matter.

Benefits of Joining smava Kreditpartnerprogramm

High-Intent Financial Traffic

Users searching for loans are already motivated, improving conversion chances.

Strong Conversion Potential

smava’s optimized funnels and trusted brand help turn clicks into applications.

Trusted Brand Advantage

Promoting a recognized name reduces user hesitation.

How to Join the smava Kreditpartnerprogramm

Step-by-Step Registration Process

- Apply through the affiliate network

- Submit your website or traffic source

- Get approval

- Start promoting smava

Approval Criteria

High-quality, compliant finance-related content increases approval chances.

Getting Started After Approval

Once approved, you gain access to links, banners, and reporting tools.

Best Promotion Strategies for smava Affiliates

SEO Content for Loan Comparisons

Target keywords like “personal loan comparison Germany” or “best loan rates DE.”

Blogs, Reviews, and Finance Guides

Educational content builds trust and improves lead quality.

Paid Traffic and Compliance Considerations

Paid ads can work well, but strict compliance with finance regulations is essential.

Marketing Tools and Affiliate Support

Affiliate Dashboard and Analytics

Track clicks, leads, and earnings in real time.

Banners, Deep Links, and Widgets

Multiple creative options allow flexible promotion strategies.

Cookie Duration and Tracking Accuracy

Reliable tracking ensures fair attribution of conversions.

smava Kreditpartnerprogramm for Beginners

Is This Program Beginner-Friendly?

It’s best suited for affiliates with some experience in SEO or finance content.

Learning Curve and Monetization Potential

Once you understand compliance and targeting, earnings can scale well.

Common Mistakes to Avoid

Misleading claims, poor disclosures, or low-quality traffic.

Also Read

Why DHgate Is Popular for Bulk Online Shopping

Why (IS) Interserver Webhosting and VPS Is Trusted by Businesses

Holiday Autos: Complete Guide to Affordable Car Rentals Worldwide

How Jainsons Lights P. Ltd Is Revolutionizing Modern Lighting Design

Why Swimmers Trust SwimOutlet.com for Affordable Swimwear

Earnings Potential: How Much Can You Make?

Low-Traffic vs High-Traffic Scenarios

Even modest traffic can generate solid commissions due to high lead value.

Quality Leads vs Quantity

Targeted traffic converts better than mass, untargeted visitors.

Scaling Your Affiliate Income

More optimized content equals higher lifetime earnings.

Comparing smava With Other German Finance Affiliate Programs

Brand Recognition Comparison

smava often outperforms lesser-known platforms due to trust.

Commission Reliability

Consistent payouts and transparent reporting add stability.

Long-Term Monetization Value

Finance content remains evergreen and profitable.

Legal and Compliance Considerations in Germany

Financial Advertising Regulations

German finance advertising rules are strict—accuracy is critical.

Disclosure and Transparency

Clear affiliate disclosures build user trust and legal safety.

Building User Trust

Honesty converts better than hype.

Is smava Kreditpartnerprogramm Worth It?

Key Pros

- Trusted German brand

- High-intent users

- Strong conversion funnels

Potential Cons

- Competitive niche

- Compliance requirements

Conclusion

The smava Kreditpartnerprogramm DE stands out as a strong affiliate opportunity in the German finance market. With a trusted brand, high user intent, and reliable commission structure, it offers solid earning potential for affiliates who prioritize quality and transparency. If you’re serious about finance affiliate marketing in Germany, smava is a program worth considering.

Frequently Asked Questions

Yes, joining the program is completely free.

Affiliates earn per qualified lead or completed loan application.

It’s better for affiliates with some finance or SEO experience.

Yes, banners, links, and widgets are available.

Yes, SEO is one of the most effective strategies.

Table of Contents

Popular Posts

-

Affordable Technical SEO Audit for Small Business: A Complete Guide26 Jun 2025 Blog

Affordable Technical SEO Audit for Small Business: A Complete Guide26 Jun 2025 Blog -

How to Get an Affordable Technical SEO Audit for Small Business27 Jun 2025 Blog

How to Get an Affordable Technical SEO Audit for Small Business27 Jun 2025 Blog -

The Ultimate Local SEO Audit Checklist for Startups28 Jun 2025 Blog

The Ultimate Local SEO Audit Checklist for Startups28 Jun 2025 Blog -

Local SEO Audit Checklist for Startups: A Beginner’s Guide28 Jun 2025 Blog

Local SEO Audit Checklist for Startups: A Beginner’s Guide28 Jun 2025 Blog -

Top On-Page SEO Audit Steps for Service Websites Every Business Should Know29 Jun 2025 Blog

Top On-Page SEO Audit Steps for Service Websites Every Business Should Know29 Jun 2025 Blog -

The Impact of On-Page SEO Audit Steps for Service Websites on UX01 Jul 2025 Blog

The Impact of On-Page SEO Audit Steps for Service Websites on UX01 Jul 2025 Blog -

Technical SEO for WordPress: The Ultimate Beginner’s Guide01 Jul 2025 Blog

Technical SEO for WordPress: The Ultimate Beginner’s Guide01 Jul 2025 Blog -

Technical Mobile SEO Audit Tips for Developers02 Jul 2025 Blog

Technical Mobile SEO Audit Tips for Developers02 Jul 2025 Blog