The blog post “Credit Glory Review 2025: Can It Really Fix Your Credit Score Fast?” provides an in-depth analysis of how Credit Glory helps users repair their credit reports quickly and effectively. It covers the company’s services, pricing, performance, and customer experiences, offering readers a transparent look at whether Credit Glory is a legitimate and reliable option for improving credit scores in 2025.

Table of Contents

Introduction

In today’s economy, maintaining a good credit score is more important than ever. Whether you’re applying for a mortgage, a car loan, or even a job, your credit history plays a big role. That’s where Credit Glory steps in. In this 2025 review, we’ll take an honest look at how this credit repair company operates, what it offers, and whether it can truly help you fix your credit score fast.

What Is Credit Glory?

Credit Glory is a professional credit repair company based in the U.S. that helps individuals remove inaccurate or unfair negative items from their credit reports. Founded in 2017, the company’s mission is to help people rebuild their credit without stress or confusing processes.

Their main focus is on simplifying credit repair — giving customers access to expert help without long-term contracts or hidden fees.

How Credit Glory Works

Credit Glory’s process is simple and transparent:

- Free Consultation: Customers start with a no-obligation credit evaluation.

- Credit Audit: Their team reviews your credit report from major bureaus — Experian, Equifax, and TransUnion — to identify errors.

- Dispute Phase: They file disputes directly with the bureaus on your behalf.

- Results Monitoring: You’ll get updates as items are removed or corrected.

Each step is designed to make the credit repair process smooth and stress-free, even for beginners.

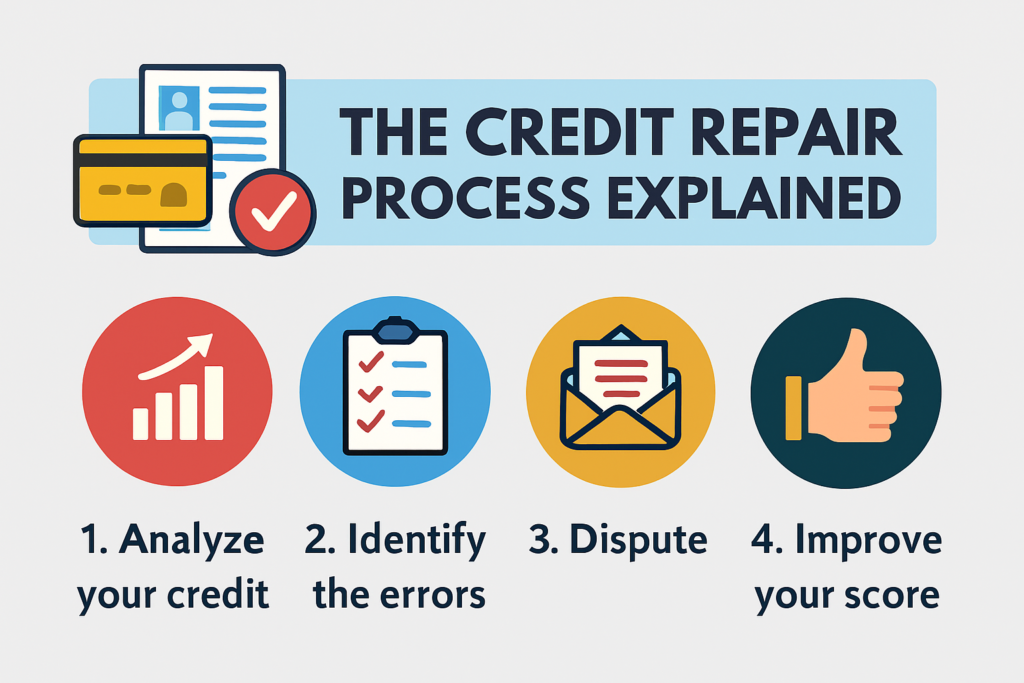

The Credit Repair Process Explained

- Identifying Errors: Many credit reports contain inaccuracies — such as old debts, duplicate accounts, or misreported late payments.

- Filing Disputes: Credit Glory uses data-driven tools and legal frameworks to challenge these inaccuracies with the bureaus.

- Monitoring Progress: Clients receive updates every 30–45 days as disputes are resolved.

This structured approach ensures no mistake on your report goes unchallenged.

Key Features of Credit Glory

- Personalized Credit Audit: Each client receives a detailed credit analysis.

- Unlimited Disputes: They don’t limit the number of disputes per month.

- Dedicated Credit Experts: You’re assigned a specialist for one-on-one support.

- Cancel Anytime Policy: No binding contracts — you pay monthly and can cancel easily.

This customer-first approach sets Credit Glory apart from traditional credit repair companies.

Credit Glory Pricing and Plans (2025 Update)

As of 2025, Credit Glory charges $99 per month after a one-time first-work fee of $199.

✅ Free Consultation

✅ Monthly Payment Model

✅ Full Refund Guarantee — If no items are removed within 90 days, you can request a refund.

This straightforward pricing model ensures transparency without surprise charges.

Performance and Results

Most users see improvements in their credit reports within 45–90 days, though full results may take longer depending on the complexity of your credit history.

In many verified cases, clients reported credit score increases between 50–150 points within three months — a significant improvement for those working toward loan approvals or better interest rates.

Who Should Use Credit Glory?

Credit Glory is ideal for:

- Individuals with inaccurate or outdated negative items on their credit reports.

- People looking for a hands-off, expert-driven approach.

- Anyone who values flexible, contract-free credit repair services.

If your credit report is already accurate but low due to missed payments or high debt, you may benefit more from credit counseling or debt management instead.

Is Credit Glory Legit or a Scam?

Credit Glory is 100% legitimate. The company is accredited by the Better Business Bureau (BBB) and holds strong reviews across multiple platforms, including Trustpilot, where it averages over 4.6 stars.

They operate under the Credit Repair Organizations Act (CROA), ensuring ethical business practices and consumer protection.

Pros and Cons of Using Credit Glory

Pros

- No long-term commitment required

- Transparent pricing

- High success rate with disputes

- Excellent customer support

Cons

- Results can take several months

- No mobile app yet

- Limited financial education materials

Also Read

What Is Sonetel and How Can It Benefit Your Business Communication?

Dartmouth Brands Marketing Strategy: A Masterclass in Watch Branding

How Uniplaces Uses SEO to Attract Student Renters Worldwide

Boost Your Travel Bookings with getyourguide.it – Marketing Tips That Work

Top Reasons Why Customers Choose Klarmobil

Credit Glory vs Competitors

Credit Glory vs Lexington Law

Lexington Law offers legal-backed services but is pricier. Credit Glory’s advantage lies in its flexibility and personal attention without binding contracts.

Credit Glory vs CreditRepair.com

CreditRepair.com uses a subscription model with set dispute limits. Credit Glory’s unlimited dispute policy offers better value for many customers.

Customer Reviews and Testimonials

Many customers in 2025 have praised Credit Glory for delivering visible results within weeks and maintaining excellent communication throughout the process.

“Credit Glory helped remove two collection accounts and boosted my score by 80 points in two months!” – Verified Trustpilot Review

Some users mention slower results depending on their case complexity, but overall satisfaction remains consistently high.

Credit Education Resources

Credit Glory goes beyond dispute handling. They provide resources on:

- How to maintain a healthy credit score

- Managing credit utilization

- Understanding your rights under the Fair Credit Reporting Act (FCRA)

This focus on education empowers users to stay financially responsible long after their reports are cleaned.

Does Credit Glory Really Fix Credit Fast?

The term “fast” in credit repair is relative. While some customers notice improvements within 30 days, others may take up to 6 months.

Credit Glory’s success depends on the accuracy of disputes and the response time of credit bureaus. However, their strategic approach often accelerates results compared to DIY methods.

Security and Data Protection

With cybersecurity threats on the rise, Credit Glory prioritizes data privacy. All customer information is encrypted, and their systems comply with major data protection regulations, ensuring your financial details stay safe.

Conclusion

So, can Credit Glory really fix your credit score fast in 2025?

The answer is yes — but with realistic expectations. Credit Glory offers a transparent, efficient, and customer-focused approach to repairing credit. While it’s not magic, it’s one of the most trustworthy services available for those looking to rebuild financial stability with confidence.

If you’re struggling with credit issues and want a service that values transparency and results, Credit Glory is worth considering.

Frequently Asked Questions

Typically, clients see noticeable improvements within 45–90 days.

Yes. If no items are removed from your report within 90 days, you can request a full refund.

Absolutely. They use secure, encrypted systems to protect your data.

Yes, Credit Glory operates on a no-contract policy — you can cancel whenever you wish.

They can remove inaccurate or unverifiable items but not legitimate debts or late payments.

Table of Contents

Popular Posts

-

Affordable Technical SEO Audit for Small Business: A Complete Guide26 Jun 2025 Blog

Affordable Technical SEO Audit for Small Business: A Complete Guide26 Jun 2025 Blog -

How to Get an Affordable Technical SEO Audit for Small Business27 Jun 2025 Blog

How to Get an Affordable Technical SEO Audit for Small Business27 Jun 2025 Blog -

The Ultimate Local SEO Audit Checklist for Startups28 Jun 2025 Blog

The Ultimate Local SEO Audit Checklist for Startups28 Jun 2025 Blog -

Local SEO Audit Checklist for Startups: A Beginner’s Guide28 Jun 2025 Blog

Local SEO Audit Checklist for Startups: A Beginner’s Guide28 Jun 2025 Blog -

Top On-Page SEO Audit Steps for Service Websites Every Business Should Know29 Jun 2025 Blog

Top On-Page SEO Audit Steps for Service Websites Every Business Should Know29 Jun 2025 Blog -

The Impact of On-Page SEO Audit Steps for Service Websites on UX01 Jul 2025 Blog

The Impact of On-Page SEO Audit Steps for Service Websites on UX01 Jul 2025 Blog -

Technical SEO for WordPress: The Ultimate Beginner’s Guide01 Jul 2025 Blog

Technical SEO for WordPress: The Ultimate Beginner’s Guide01 Jul 2025 Blog -

Technical Mobile SEO Audit Tips for Developers02 Jul 2025 Blog

Technical Mobile SEO Audit Tips for Developers02 Jul 2025 Blog