Fidelcrest Investment Review: Funding Model, Risks, and Opportunities

Fidelcrest Investment Review explores Fidelcrest’s proprietary trading funding model, explaining how traders get funded, the key risks involved, and the real opportunities for profit. This guide helps traders understand whether Fidelcrest Investment is suitable for their trading goals, risk tolerance, and long-term growth strategy.

Table of Contents

Introduction to Fidelcrest as a Proprietary Trading Firm

If you’ve ever dreamed of trading large capital without risking your own savings, proprietary trading firms probably caught your attention. Among them, Fidelcrest has been making waves in the prop trading ecosystem. But here’s the big question: Is Fidelcrest actually worth your time and money?

This in-depth Fidelcrest investment review breaks everything down—its funding model, real risks, and genuine opportunities—so you can decide with confidence rather than hype.

What Is Fidelcrest?

Overview of the Company

Fidelcrest is a proprietary trading firm that provides traders with access to funded accounts after they pass an evaluation process. Instead of depositing your own capital and risking heavy losses, you trade the firm’s money and keep a share of the profits.

Think of it like a driving test. Prove you can drive safely, and you’re handed the keys to a powerful car.

Who Can Join Fidelcrest?

Fidelcrest is open to:

- Retail forex traders

- Index and commodity traders

- Crypto traders with discipline

- Beginners with solid risk management

You don’t need a finance degree—just consistency, patience, and respect for rules.

How Fidelcrest’s Funding Model Works

This is the heart of the Fidelcrest business model, and honestly, it’s what attracts most traders.

Evaluation-Based Funding Explained

Fidelcrest mainly uses a challenge-based funding system.

Normal Challenge Model

This model is designed for disciplined traders:

- Moderate profit targets

- Conservative drawdown limits

- Lower psychological pressure

It’s like running a marathon—steady pace wins.

Aggressive Challenge Model

This one’s for confident risk-takers:

- Higher profit targets

- Tighter loss rules

- Faster evaluation timeline

More reward, more stress. No middle ground.

Instant Funding Option

For traders who don’t want evaluations, Fidelcrest offers instant funding. You pay a higher fee, skip the challenge, and start trading immediately—though with stricter rules.

Trading Rules and Account Conditions

Rules aren’t there to punish you—they’re there to protect capital.

Drawdown Rules

- Maximum drawdown limits total account loss

- Breaching it = account termination

Simple, strict, non-negotiable.

Daily Loss Limits

Daily loss caps prevent emotional revenge trading. One bad day shouldn’t end a trading career.

Markets and Assets You Can Trade

Forex Pairs

Major, minor, and selected exotic pairs are available with tight spreads.

Indices

Trade popular indices like US30, NASDAQ, DAX, and more.

Commodities

Gold, silver, oil—perfect for macro and news-based strategies.

Cryptocurrencies

Crypto trading is available but often with tighter risk limits due to volatility.

Technology and Trading Platforms

Supported Platforms

Fidelcrest supports industry-standard platforms, ensuring familiarity and flexibility.

Execution Speed and Reliability

Fast execution and stable servers reduce slippage—critical for scalpers and intraday traders.

Costs, Fees, and Refund Policy

Challenge Fees

You pay a one-time evaluation fee depending on account size and model chosen.

Refund Conditions

Pass the challenge, and your fee is often refunded with your first payout—effectively making the evaluation risk-free if you succeed.

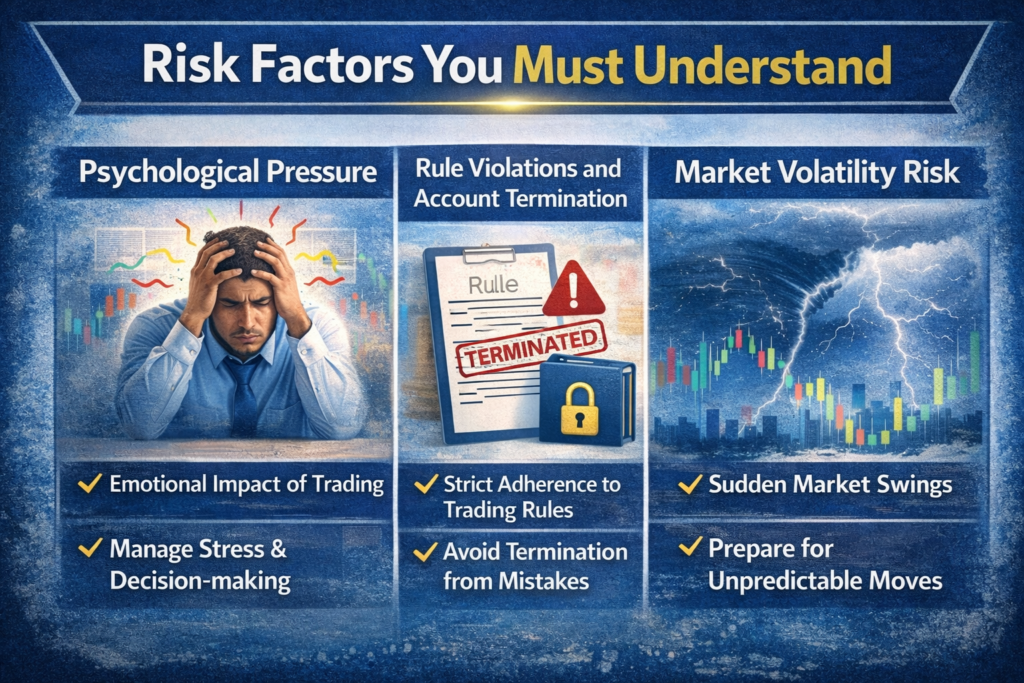

Risk Factors You Must Understand

Let’s be real—this isn’t easy money.

Psychological Pressure

Trading under rules can feel like trading with a clock ticking in your head.

Rule Violations and Account Termination

One mistake—like exceeding drawdown—and the account is gone.

Market Volatility Risk

News events can wipe accounts if risk isn’t controlled.

Opportunities for Traders

Scaling Plans

Successful traders can scale to larger capital, increasing income without increasing personal risk.

Career Growth for Skilled Traders

For consistent traders, Fidelcrest can act as a stepping stone to a professional trading career.

Pros of Fidelcrest

- Access to large trading capital

- High profit splits

- Multiple funding models

- Transparent rules

- Refundable evaluation fees

Also Read

Invoxia Affiliate Program Guide: Strategies to Maximize Affiliate Revenue

Atlas VPN Review: Security, Speed, and Privacy Explained

Online Check Writer Review: Simplifying Business Payments

Why Content Marketing Is Crucial for Society6 Growth

How Social Media Strategy Strengthens Mixhers Brand Awareness

Cons of Fidelcrest

- Strict rules not suited for gamblers

- Psychological pressure during challenges

- Fees can be expensive for beginners

Fidelcrest vs Other Prop Trading Firms

Key Differences

Fidelcrest stands out with flexible models and aggressive options that many competitors avoid.

Who Fidelcrest Is Best For

- Disciplined traders

- Strategy-based traders

- Traders with proven consistency

Not ideal for impulsive or emotional traders

Is Fidelcrest Legit or a Scam?

Transparency and Reputation

Fidelcrest is transparent about rules, fees, and conditions—no hidden surprises.

Trader Reviews and Feedback

Most negative reviews come from rule violations, not payout issues—a big green flag in prop trading.

Tips to Pass the Fidelcrest Challenge

Risk Management Strategies

- Risk 0.5–1% per trade

- Avoid overtrading

- Respect drawdown limits

Who Should Invest Time and Money in Fidelcrest?

If you’re patient, rule-focused, and serious about trading as a profession, Fidelcrest can be a powerful opportunity. If you chase fast money—this isn’t for you.

Conclusion

Fidelcrest’s funding model rewards discipline, not luck. Both the potential and the threats are genuine. Treat it like a professional exam—not a casino—and it can genuinely change your trading journey.

Frequently Asked Questions

Yes, if beginners focus on risk management and learning—not fast profits.

Yes, once funded and eligible, payouts are processed on a scheduled basis.

Rules vary by account type—always check before trading high-impact news.

The account is terminated immediately, even if profitable.

It depends on your trading style. Fidelcrest suits disciplined traders best.

Table of Contents

Popular Posts

-

Affordable Technical SEO Audit for Small Business: A Complete Guide26 Jun 2025 Blog

Affordable Technical SEO Audit for Small Business: A Complete Guide26 Jun 2025 Blog -

How to Get an Affordable Technical SEO Audit for Small Business27 Jun 2025 Blog

How to Get an Affordable Technical SEO Audit for Small Business27 Jun 2025 Blog -

The Ultimate Local SEO Audit Checklist for Startups28 Jun 2025 Blog

The Ultimate Local SEO Audit Checklist for Startups28 Jun 2025 Blog -

Local SEO Audit Checklist for Startups: A Beginner’s Guide28 Jun 2025 Blog

Local SEO Audit Checklist for Startups: A Beginner’s Guide28 Jun 2025 Blog -

Top On-Page SEO Audit Steps for Service Websites Every Business Should Know29 Jun 2025 Blog

Top On-Page SEO Audit Steps for Service Websites Every Business Should Know29 Jun 2025 Blog -

The Impact of On-Page SEO Audit Steps for Service Websites on UX01 Jul 2025 Blog

The Impact of On-Page SEO Audit Steps for Service Websites on UX01 Jul 2025 Blog -

Technical SEO for WordPress: The Ultimate Beginner’s Guide01 Jul 2025 Blog

Technical SEO for WordPress: The Ultimate Beginner’s Guide01 Jul 2025 Blog -

Technical Mobile SEO Audit Tips for Developers02 Jul 2025 Blog

Technical Mobile SEO Audit Tips for Developers02 Jul 2025 Blog